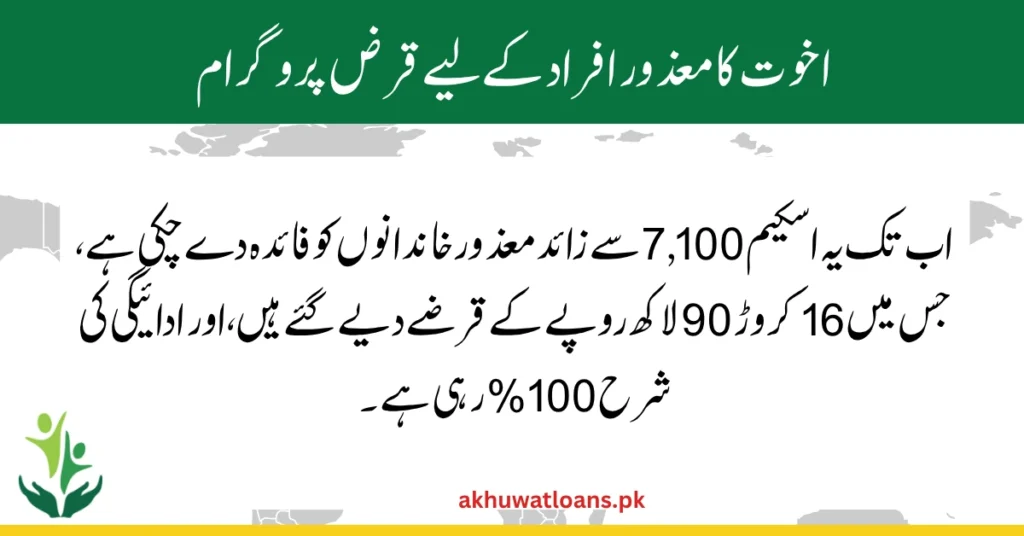

Akhuwat, through a special partnership with the Punjab Social Protection Authority, offers interest‑free micro‑loans specifically for persons with disabilities (PWDs) in Punjab. Here’s a clear overview of the program:

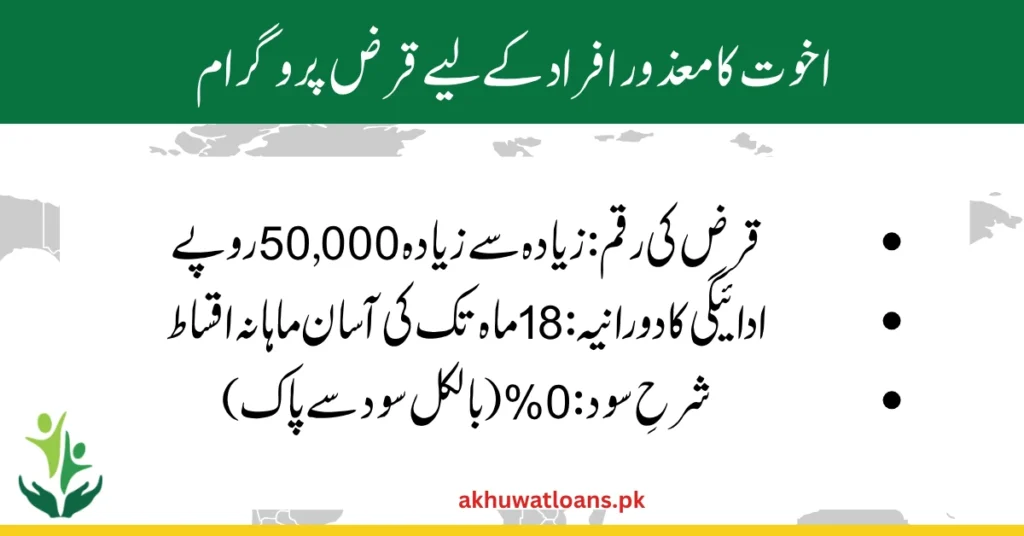

Key Features of the PWD Loan Scheme

- Loan Amount: Up to PKR 50,000 per borrower, interest‑free

- Repayment: Monthly installments over a period up to 18 months, with 0% interest

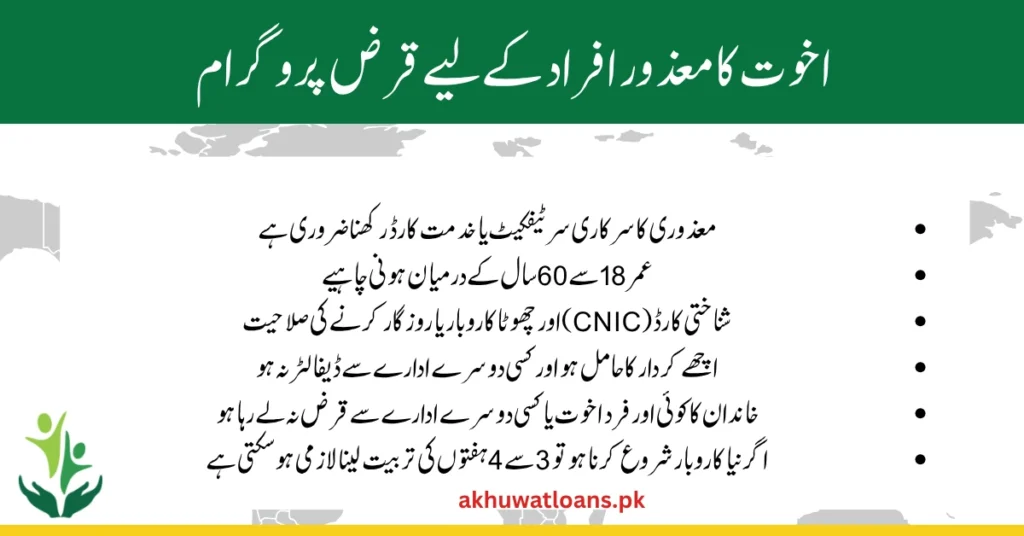

Eligibility Requirements for Akhuwat Loan Scheme

- Must be certified as disabled by an authorized medical board, or hold a Khidmat Card, and able to present a viable business plan

- Be between 18–60 years of age

- Hold a valid CNIC and be economically active

- Good character in the community, and loan‑default free from other institutions

- No active loan within the family from Akhuwat or other microfinance sources

- Applicants with business ideas should be willing to undergo training for 3–4 weeks

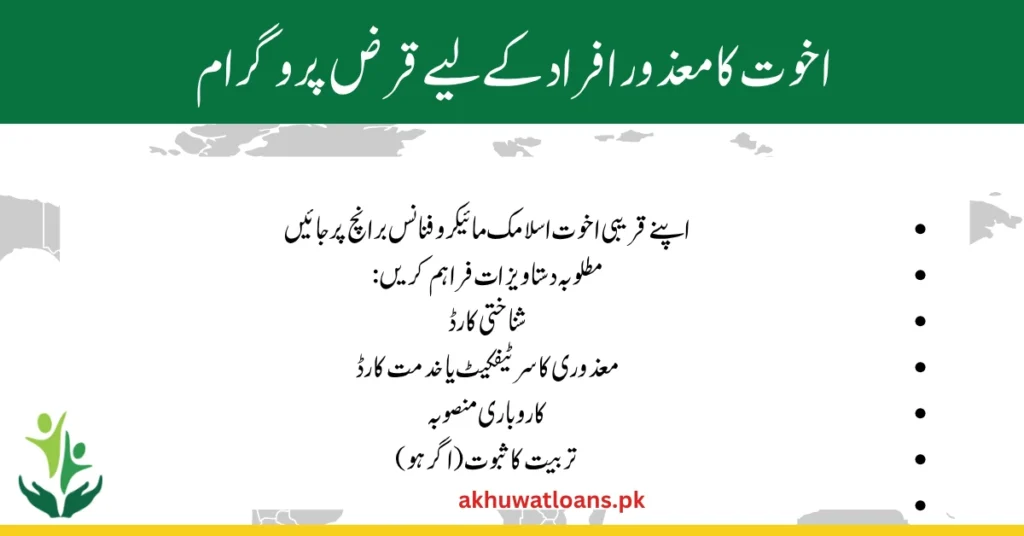

Application & Disbursement Process

- Submit a completed loan application at your nearest Akhuwat Islamic Microfinance‑branch or associated outlet.

- Provide documentation: CNIC, disability certification or Khidmat Card, business plan, and proof of training (if applicable).

- Akhuwat’s team will conduct social and business appraisals.

- Loans are approved on a first‑come, first‑served basis, via either group or individual lending methods

- Funds are disbursed monthly, either via bank transfers or through community centers

What You Can Do Next

- Visit an Akhuwat branch in your district (look under their Islamic Microfinance program)

- Alternatively, check the Punjab Social Protection Authority for other PWD support programs

- Prepare the required documents and express your interest in the Graduation & Income Generation Scheme for PWDs