Akhuwat is a leading nonprofit organization in Pakistan dedicated to alleviating poverty through interest-free microfinance and a range of social services. Founded in 2001 by Dr. Muhammad Amjad Saqib, Akhuwat provides interest-free loans—known as Qarz-e-Hasna—to individuals who lack access to traditional banking due to insufficient income or collateral. Its mission is to empower marginalized families, enabling them to start or expand small businesses and achieve self-reliance

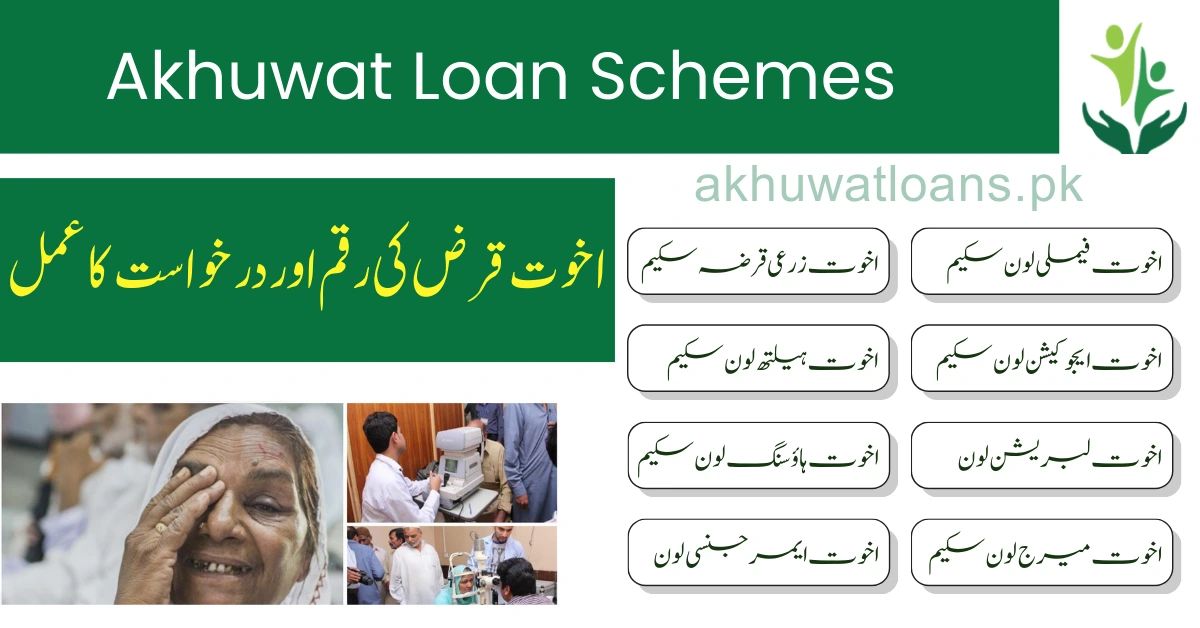

Akhuwat is one of Pakistan’s most trusted non-profit organizations. It offers interest-free loans to help poor and deserving people improve their lives. With the aim of ending poverty and promoting self-reliance, Akhuwat provides various loan products for different needs. These loans are given without any interest, and people return them in small, easy installments.

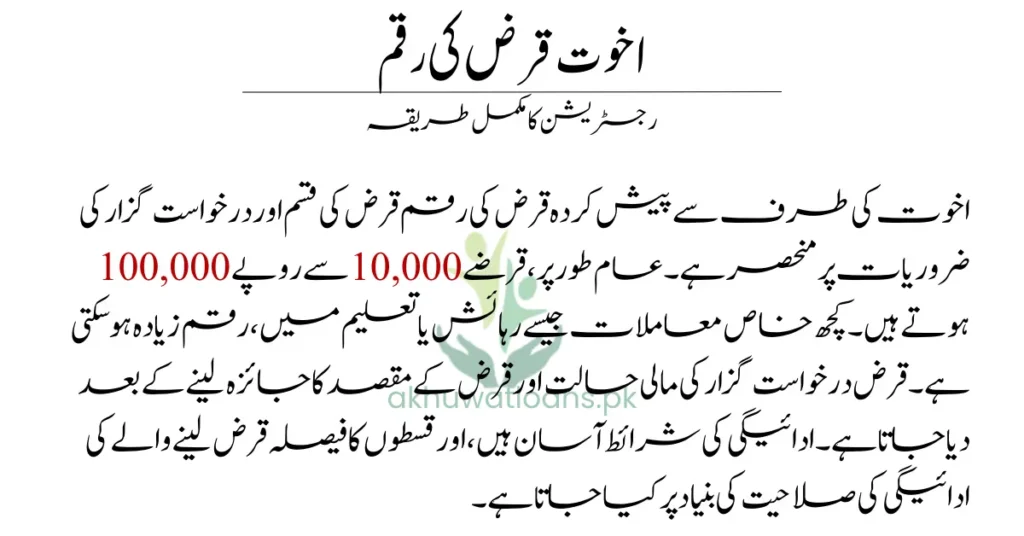

Akhuwat Loan Amount

The loan amount offered by Akhuwat depends on the type of loan and the applicant’s needs. Generally, loans range from Rs. 10,000 to Rs. 100,000. In some special cases like housing or education, the amount may be higher. The loan is given after reviewing the applicant’s financial condition and purpose of the loan. Repayment terms are easy, and installments are decided based on the borrower’s capacity to pay.

1. Akhuwat Family Loan Scheme

This is the most common loan offered by Akhuwat. It is designed to help individuals start or grow small businesses to support their families. People use this loan for activities like opening a shop, tailoring, selling vegetables, or home-based work. The goal is to help people earn a stable income and become self-sufficient.

- Loan Range: Rs. 10,000 to Rs. 150,000

- Repayment Period: 10–36 months

- Profit Rate: 0%

- Most Applications Fee: Rs. 200

2. Agriculture Loan Scheme

This loan is specially for farmers. It helps them buy seeds, fertilizers, tools, or other farming equipment. It also supports them in harvesting and other farming tasks. With this loan, farmers can increase their productivity and improve their income.

- Loan Range: Rs. 10,000 to Rs. 50,000

- Repayment Period: 4–8 months

- Profit Rate: 0%

- Most Applications Fee: Rs. 200

3. Akhuwat Liberation Loan

Many poor people borrow money from private moneylenders who charge high interest. This often traps them in debt. Akhuwat Liberation Loan is given to help such people pay off their debts and break free from financial burden. This loan brings relief and gives them a fresh start without interest.

Apply For Loan

Find Nearest Branch to Apply For Loan Click Below to find branch details

- Loan Range: Rs. 10,000 to Rs. 100,000

- Repayment Period: 10–36 months

- Profit Rate: 0%

- Most Applications Fee: Rs. 200

4. Akhuwat Housing Loan

This loan helps low-income families build or improve their homes. People can use this loan to construct a house, add a room, or repair their existing home. It provides a safe and respectable living space for families in need.

- Loan Range: Rs. 30,000 to Rs. 500,000

- Repayment Period: 13–60 months

- Profit Rate: 7% (for housing loans only)

- Most Applications Fee: Up to Rs. 200

5. Akhuwat Education Loan

Education is the key to a better future. Akhuwat offers education loans to students who cannot afford school or university fees. These loans cover tuition, books, and other education-related expenses. It allows students to continue their studies without worrying about money.

- Loan Range: Rs. 10,000 to Rs. 100,000

- Repayment Period: 10–36 months

- Profit Rate: 0%

- Most Applications Fee: Rs. 200

6. Health Loan Scheme

Medical emergencies can be very costly, especially for poor families. Akhuwat provides health loans to help people cover hospital bills, medicines, surgeries, and other health expenses. This loan ensures that no one is left untreated due to lack of money.

- Loan Range: Rs. 10,000 to Rs. 60,000

- Repayment Period: 10–36 months

- Profit Rate: 0%

- Most Applications Fee: Rs. 200

7. Akhuwat Marriage Loan

Marriage expenses can be a big burden for low-income families. Akhuwat Marriage Loan is given to support families who cannot afford the wedding costs of their children. It helps them celebrate the special day with dignity and without financial stress.

- Loan Range: Rs. 10,000 to Rs. 100,000

- Repayment Period: 10–36 months

- Profit Rate: 0%

- Most Applications Fee: Rs. 200

8. Emergency Loan Scheme

Sometimes, people face sudden emergencies like accidents, job loss, or natural disasters. Akhuwat’s Emergency Loan provides quick financial help during such times. This loan helps families handle urgent needs without falling into debt.

- Loan Range: Rs. 10,000 to Rs. 40,000

- Repayment Period: 10–36 months

- Profit Rate: 0%

- Most Applications Fee: Rs. 200